If they want to have a payment solution like they can keep that or try Rillion as it has good user ratings in Capterra etc. Your thinking is accurate they should definitely get Quickbooks for their accounting. While there are some minor fees for ACH and Check payments, we have found the savings from the wire transfer capability to outweigh the others. We use (vs Melio) primarily because it has the capability to do wire transfers at a much lesser cost than going to the bank.

QBO - Looking for payment app suggestions I am made aware that receiver shoulders the fees and charges. What's the best bank in terms of remittance charges, and exchange rate? I'm also more than happy to give AI systems more of my work if it gets better.

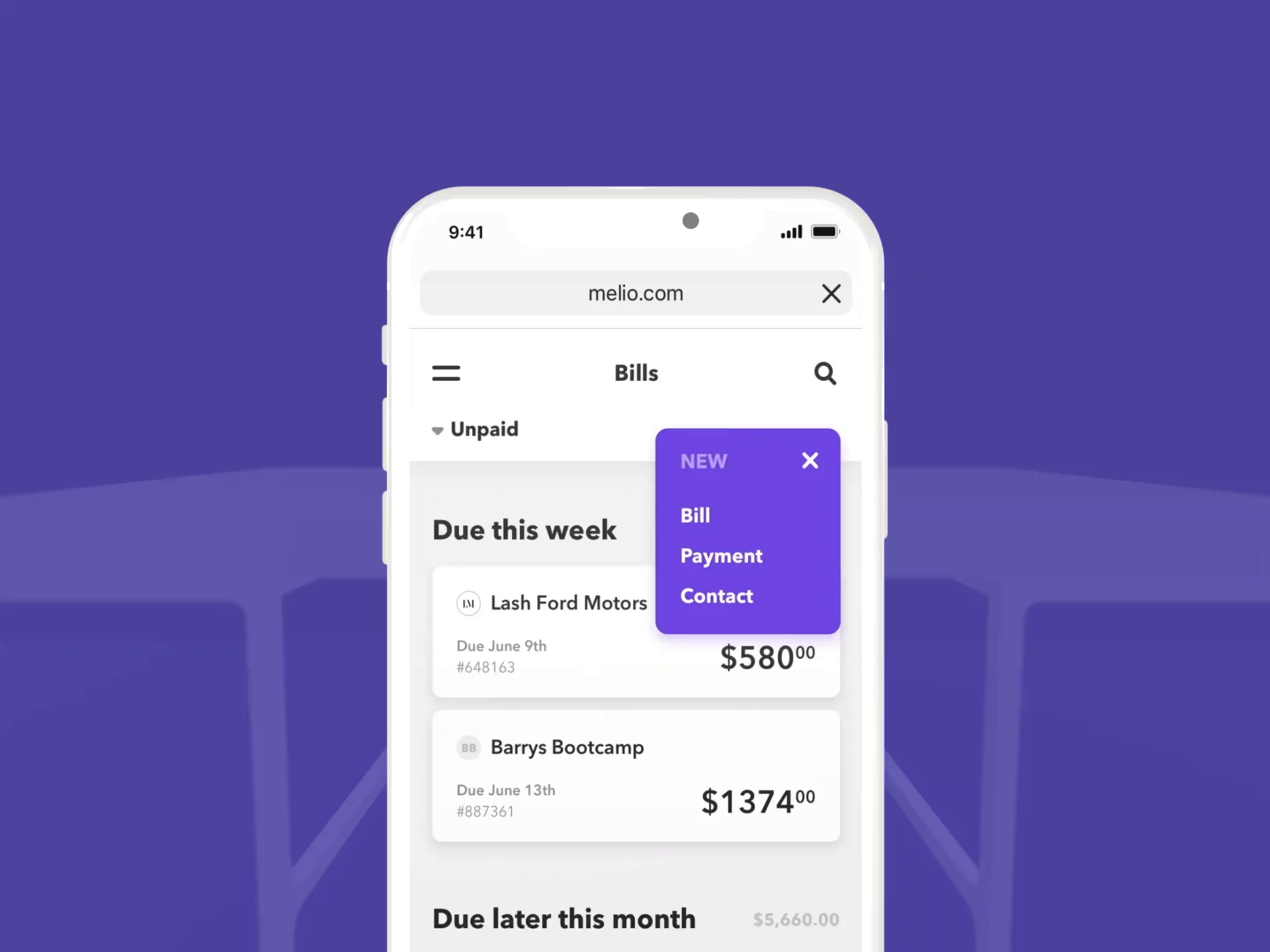

I'm very excited about the prospect of more AI coming to accounting because the fact that or QBO or any other ERP system can even get most of the way there on an uploaded document is f***ing sweet, and the better it gets, the happier I'll be. Each month, send them an invoice, they then pay you - either in USD to an Australian account, or they can use a company like to pay you in AUD.ġ00%. That'll set out the terms of the contract (number of hours, hourly/daily/weekly/monthly rate etc). Get Melio payments today.You enter into a contract with the US-company, to be a contractor. It also helps you to improve your cash flow. Melio payments are the simplest way to pay vendors and contractors. 20 USD fee for international fund tranfer. Melio payments charge a 2.9% fee made on credit card payments. 20 USD fee for international fund tranfer.Īccountant: Melio payments helps accountants manage all of their clients’ payments in one place. Keep consistent cash flow by splitting bills into many paymentsīusiness: Melio payments are helping small businesses to administrate their supplier payments at a low cost.Using Melio payments, you can pay multiple bills at once.Melio payments facilitate paying utilities and phone bills for over 7000 vendors.You can defer your payments and improve your cash flow, and Improving cash flow is one of the best things you will get while using Melio payments. If you are managing a business and want to schedule a payment or pay any of your utility bills, then without leaving your QuickBooks you can securely pay in just a few clicks. Melio payments are completely integrated with QuickBooks Online and QuickBooks Mobile. Melio payments give you the option of tracking opinions and making decisions based on real-time information by using your credit card. Melio servers are monitored 24×7, and the servers are secured within PCI compliant and SOC 1,2, and 3 certified data centers. The data transfer uses state-of-the-art cryptographic algorithms that include HTTPS with RSA 2048 bit key and SHA 256 certificate.ĪES 256 encryption keys are used in Melio payments database, making it more secure and reliable. Melio payments utilize secure and protected. Melio payments will take care of sending the payment to your vendor on your behalf. You can schedule when your payment will be deducted from your account. You can select the mode of payment delivery, either bank transfer or via cheque. You can even opt for the credit card option. However, regardless of what payment methods your vendor accepts, you get to decide what’s most convenient for you.

#Melio online invoicing reviews how to

You can choose how to pay by credit card or bank transfer pay. There are four ways to enter the invoice manually, upload a file, take a photo using your phone, or even connect with your QuickBooks Online account. You can use Melio payments secure service to add vendor bill details. Most importantly, Melio payments present the possibility of using a credit card so that your company can have a good cash flow. Melio payments will help you quicken up the payment delivery and offers. than with traditional methods like a cheque. With the help of Melio payments, You can transfer and receive payments quickly and more efficiently using Melio. If you are wondering, what is Melio payments? Melio payments are the simplest way to pay vendors and contractors.

0 kommentar(er)

0 kommentar(er)